CREDIT REPAIR🔧

GET APPROVED FOR YOUR DREAM CAR, HOME, OR BUSINESS FUNDING

START TODAY!!

CLICK BELOW TO WATCH FIRST!

Tired of being denied for loans, homes, or credit cards?

How It Works

Full Credit Audit

We pull and review your full 3-bureau report-- breaking down every detail, every negative item. Where we use MyFreeScoreNow to securely view your report.

Personalized Strategy

We craft a step-by-step plan tailored to your credit profile- no templates, just solutions that actually work.

Let's Get Started

Our team of experts will advise you to the best service needed to enhance your credit. Upon starting, your dispute will be sent out Certified Mail the in the next 2-3 days.

What You'll Receive

Full audit of 3-bureau credit report

Breakdown of negative items

Step-by-step plan of action

Fico scores Decoded

💼 Ready to Get Started Now?

Some of our clients already know which package they want and are ready to begin right away.

If you're ready to move forward without a consultation - or if you already spoken with our team - you can select your preferred plan below and get started today.

Silver PACKAGE

$30 / per month

$250 On-Boarding Fee

Removal of Inquiries

GOLD PACKAGE

$30 / per month

$350 On-boarding Fee

Removal of Inquiries

Removal of Charge-offs

Removal of Collections

Removal of Medical Bills

Removal Loan Delinquency

PLATINUM PACKAGE

$50 / per month

$500 On-boarding Fee

Certified Mail

Removal of Inquiries

Removal of Charge-offs

Removal of Collections

Removal of Medical Bills

Removal of Loan Delinquency

Removal of Repossessions

Removal of Late Payments

Removal of Derogatory Marks

TITANIUM PACKAGE

$50 / per month

$700 On-Boarding Fee

Certified Mail

Removal of Child Support

Removal of Bankruptcies

Removal of Repossessions

Removal of Student Loan Delinquencies

Removal of Inquiries

Removal of Charge-offs

Removal of Collections

Removal of Medical Bills

Removal of Evictions

Removal of Late payments

Removal of Derogatory Marks

Not Sure Which Package Is Best For You?

We Can Help...

How Our Credit Repair Process Works

Comprehensive Credit Evaluation

Begin with a FREE Credit Analysis where we dive deep into your credit report and figure out what areas need improvement. You'll receive a personalized analysis from our credit specialists, explaining your credit report and fico scores. In Addition we provide a tailor made action plan to guide you toward your financial approvals.

Enrollment

Post -Credit Analysis, enroll in our program through our website. Our steadfast team will introduce you to our online tools, grant access to your secure client portal, and address any queries via client portal.

Dispute Process

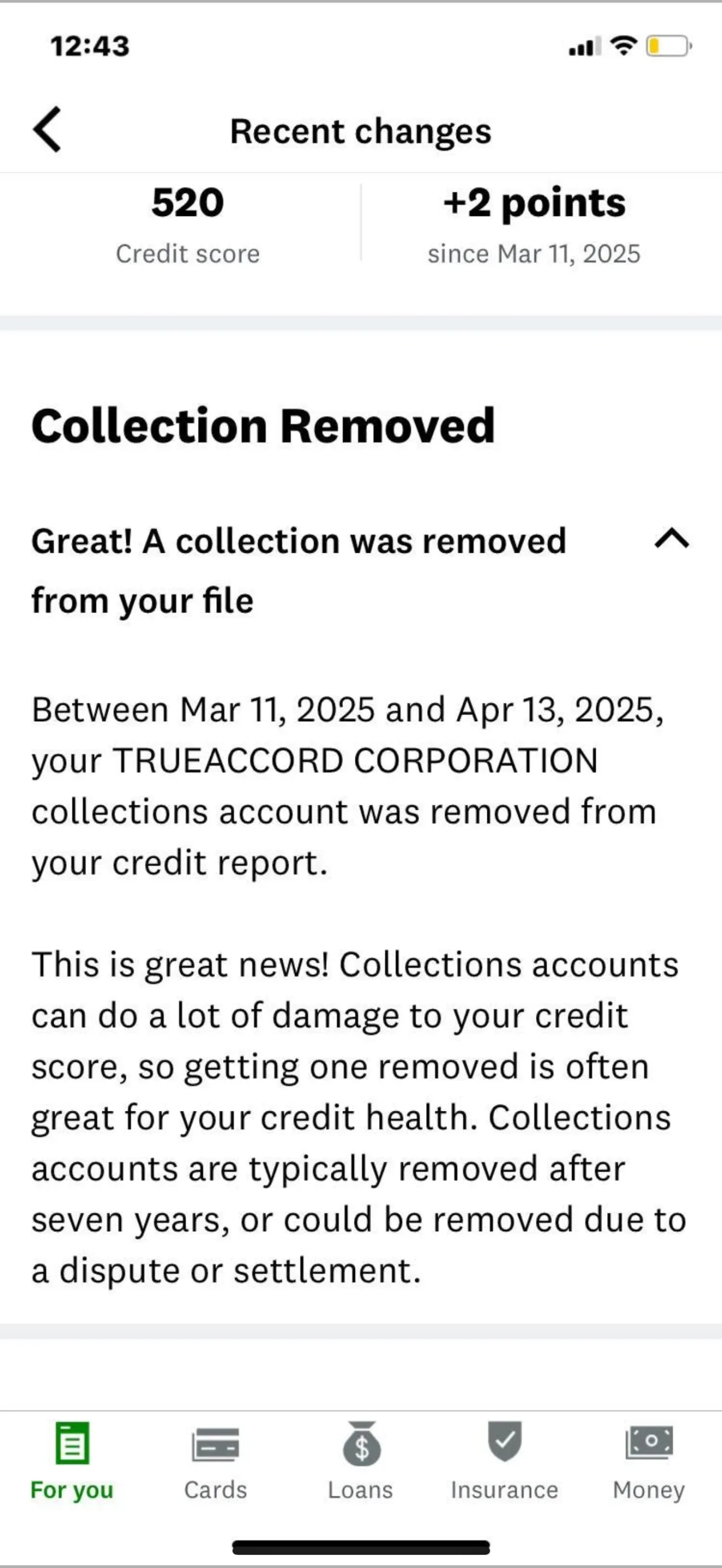

We proactively engage with the Credit Bureaus to challenge and rectify inaccuracies on your credit report. Our experts ensure the removal or erroneous, outdated, or unverifiable information, collaborating with each bureau to uphold the integrity of your credit profile.

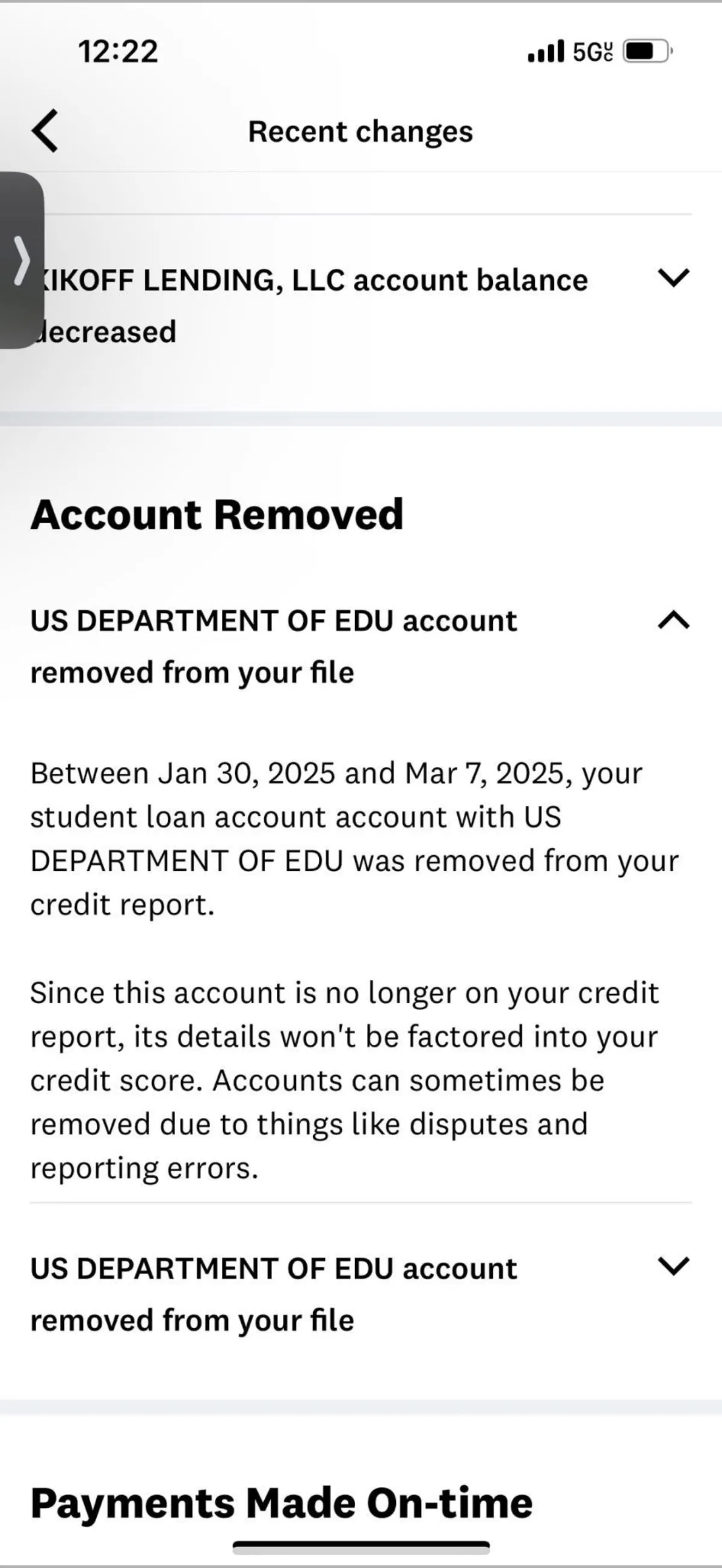

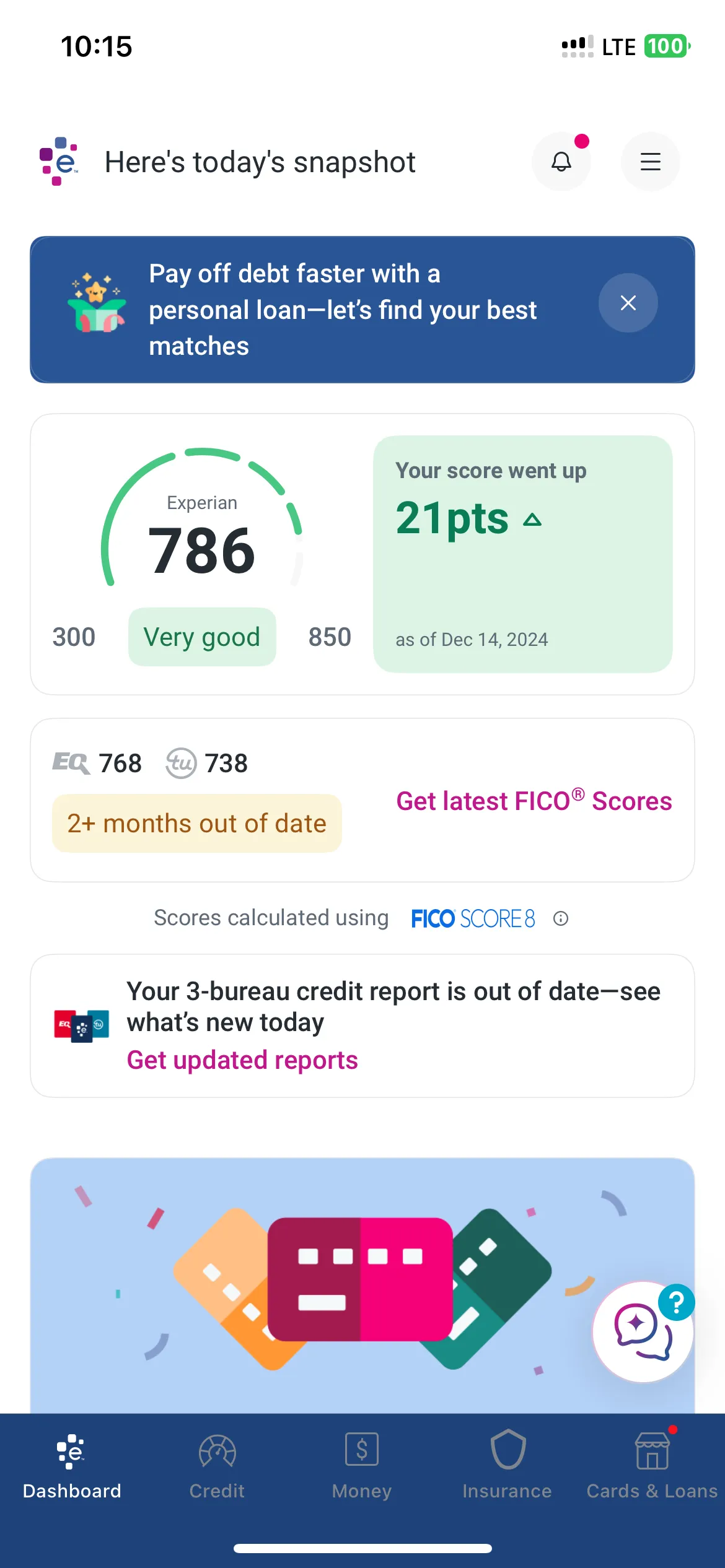

Credit Score Enhancement

Monitor the progress as we work diligently on your behalf. Utilize our online tracking tools to observe real-time updates and make informed decisions that positively impact your credit health.

Why Choose Us

Having great credit is more important than ever. But why work with us?

Integrity-Driven Services

We operate with full transparency and always put your best interest first. Trust is at the core of everything we do.

Client-first Satisfaction focus

We don't just promise results-we commit to doing everything in our power to help you move toward your goals with confidence and clarity.

tailored credit repaire plans

No two journeys are alike. That's why we create customized strategies designed specifically for your situation, helping you see results faster.

Our Mission

Our mission is to provide a cost-effective approach to improving your financial situation. Bad credit has been a generational curse for many - but now, its time to Take the Steering Wheel of our Lives and Steer our Credit in the right direction!

We're here to help you reach your goals faster. Our team has already helped countless clients boost their credit scores and take control of their financial future.

Frequently Asked Questions

How does credit repair work?

Credit repair works by identifying and disputing inaccurate, outdated, or unverifiable information on your credit report. This includes errors like late payments, collections, or accounts that don’t belong to you. Once disputed, the credit bureaus must investigate and either verify or remove the items—helping improve your credit score over time.

How long does it take to see results?

You can start seeing credit repair results in 30 to 90 days, but full results typically take 3 to 6 months, depending on how many negative items are on your report and how responsive the credit bureaus and creditors are.

Can you remove all negative items from my report?

We will challenge every single negative item that may be inaccurate, outdated, or unverifiable — that’s your legal right, and we take it seriously. While we can’t remove accurate and verified items, we’ve helped many clients improve their credit by removing the ones that shouldn’t be there in the first place. Our process is thorough, compliant, and built to give you the best possible chance at a stronger credit profile.

Wil credit repair increase my credit score?

Yes — and in many cases, it can increase it fast! When we remove negative, inaccurate, or outdated items like late payments, collections, or charge-offs, your score can start climbing.

Is credit repair legal?

Yes, credit repair is 100% legal — and it’s your right under federal law to dispute anything inaccurate, outdated, or unverifiable on your credit report. We just do the hard part for you — professionally and aggressively. This isn’t a loophole — it’s your power, and we help you use it.

Do I need to do anything during the process?

Just one thing: send us updated copies of your credit report whenever you receive them. That helps us track progress, spot changes, and keep challenging anything that shouldn’t be there. We handle the heavy lifting — you just keep us in the loop!

Does credit repair help with buying a house?

Yes, credit repair can absolutely help with buying a house. By removing negative items and improving your score, you can qualify for better mortgage rates, lower down payments, and increase your chances of approval. Stronger credit = a smoother path to homeownership.

How do I get started?

Simple — just request your free credit analysis! We’ll review your credit report, identify what’s holding you back, and show you exactly how we can help fix it. No guesswork — just a clear plan to move your credit forward.

For those of you that want to learn and save money on credit Repair I went ahead and created a software anyone can use for free. All you have to do is sign up and purchase the credit monitoring $29.99 e.g. MyFreeScoreNow. the software will show you step by step how to generate your own dispute letters!

Titos Solutions LLC © 2025

All rights reserved.

📍 Based in [DEWEY, OK] | ✉️ [email protected]

🔒 We take your privacy seriously.